Nomad Fulcrum provides the infrastructure that traditional finance and digital assets have both been missing — a compliant, two-way bridge. By integrating with global banking systems and partnerships with FINMA regulated entities, we can issue and manage investment certificates. This allows institutional investors to access DeFi through familiar financial instruments, while crypto users get exposure to traditional market assets and liquidity.

Volatile markets expose the weaknesses of most DeFi protocols and traditional strategies, where returns vanish when conditions shift. Nomad Fulcrum is built differently — guided by the principle Safety First, Yield Second. Returns are the natural outcome of a resilient foundation that combines regulated traditional markets with the innovation and liquidity of crypto. Powered by AI models and diversified liquidity sources, our framework ensures stability and consistent performance in any market conditions.

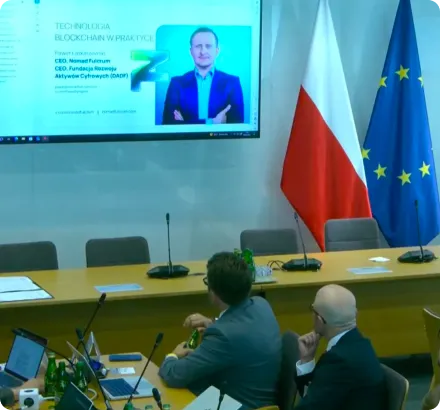

Nomad Fulcrum operates at the highest regulatory standards, partnering with FINMA-regulated financial partners to ensure institutional-grade infrastructure and secure market access. Our framework combines full compliance with crypto regulations and direct connectivity to global capital markets, giving investors confidence that every product is built on solid legal foundations. Beyond operations, we actively engage with policymakers and governmental bodies through NGO initiatives, helping shape the future of digital asset regulation. This commitment to compliance allows us to deliver innovation without compromising on trust or security

Nomad Fulcrum leverages advanced AI-driven quant models to deliver yield that is benchmark-beating, and resilient across all market conditions. By dynamically reallocating capital between crypto and traditional liquidity pools, our strategies capture opportunities regardless of volatility or macro cycles.With AI at the core, Nomad’s yield is engineered to perform when others cannot.

DeFi protocols are constrained by the limits of crypto-native liquidity, causing yields to shrink as TVL grows. Nomad Fulcrum removes this barrier by tapping directly into the vast liquidity of global capital markets in addition to crypto. This ensures that our SmartYield™ strategies scale seamlessly, generating stable returns without being diluted by inflows. For investors, it means unlimited capacity and consistent performance — independent of protocol size.

Security of assets is non-negotiable. Nomad Fulcrum partners with regulated Swiss banks and top-tier custodians to ensure that every digital and traditional asset is safeguarded under institutional standards. Our custody solutions combine multi-layer protection, regulatory oversight, and full transparency, giving investors the confidence that their capital is always secure and accessible.